Mobile Home Insurance Includes All Of The Following Except

B Liability coverage includes the cost of raising removing or destroying a sunken or wrecked yacht. A peril is something that causes or may cause injury loss or destruction such as a fire tornado or hurricane.

Understanding Your Home Insurance Declarations Page Policygenius

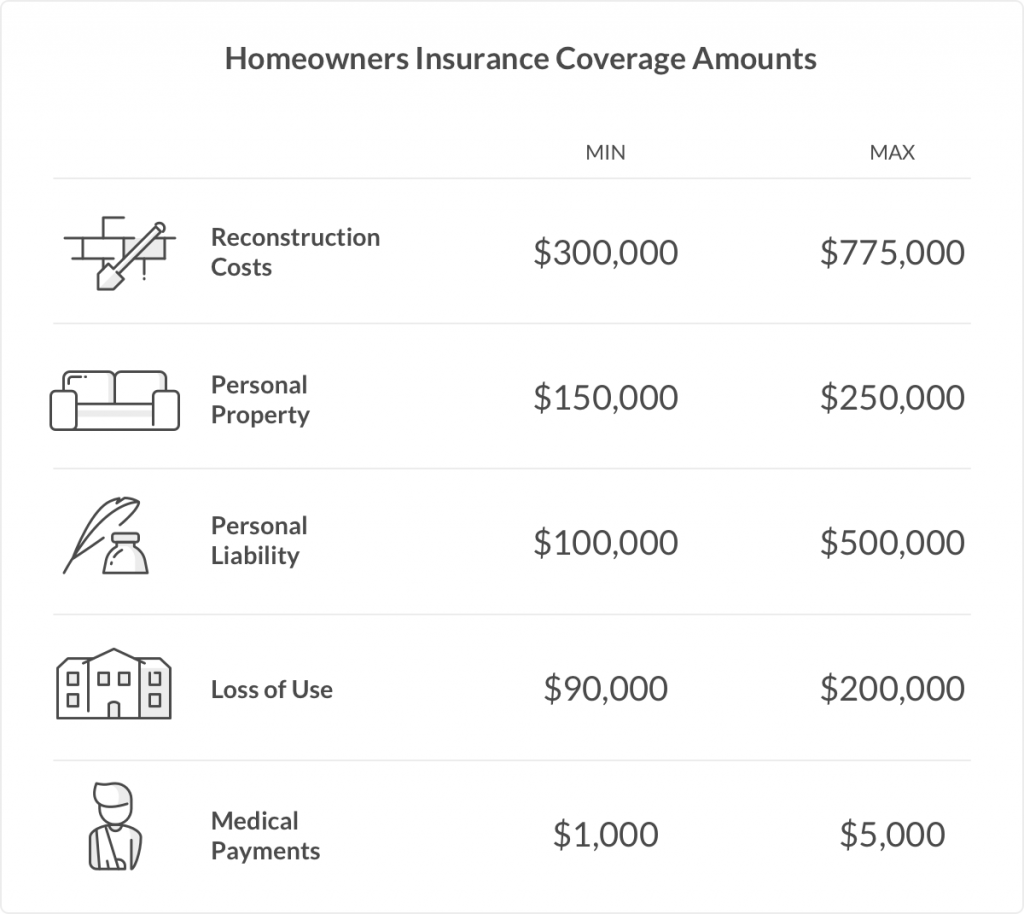

Coverage A Dwelling coverage.

Mobile home insurance includes all of the following except. Attached structures equipment and accessories which are built into and form a part of the mobile home. You will be charged an initial mortgage insurance premium MIP at closing. Mobile Home Insurance includes all of the following except.

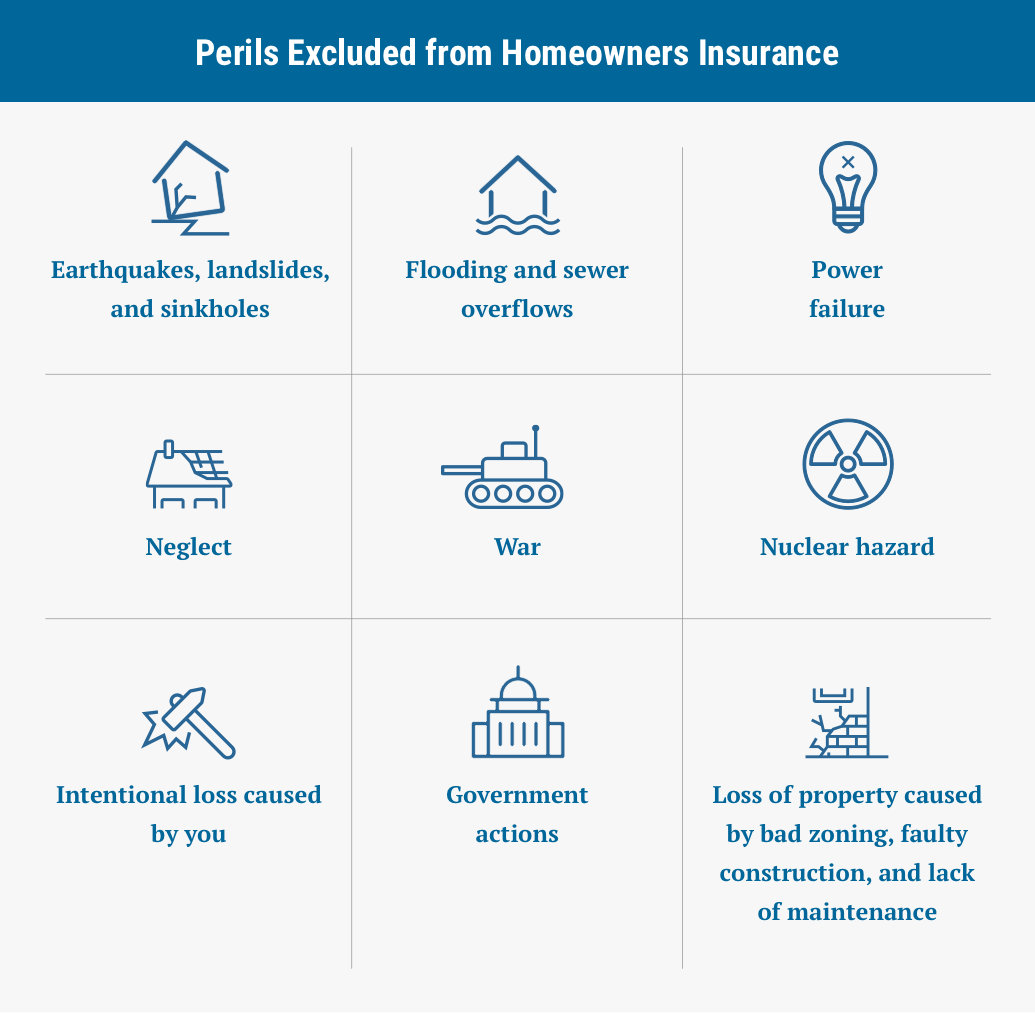

The covered auto is defined in the policy as all of the following EXCEPT. Your home has a physical condition which presents an extreme likelihood of a significant loss under a home insurance policy. As the most inclusive home insurance policy comprehensive covers both the building and its contents for all risks except for those specifically excluded.

Within the past 2 years your home insurance has been canceled because of non-payment of premium unless you pay the entire premium in full. Foremost another popular manufactured home insurer puts the. A any additional auto acquired in the past 30 days.

Electronics such as your computer are not covered under standard home insurance policies if theres a surge when the power comes back on. A Property damage coverage includes damage from insects weathering and wear and tear. Nationwide home insurance coverage.

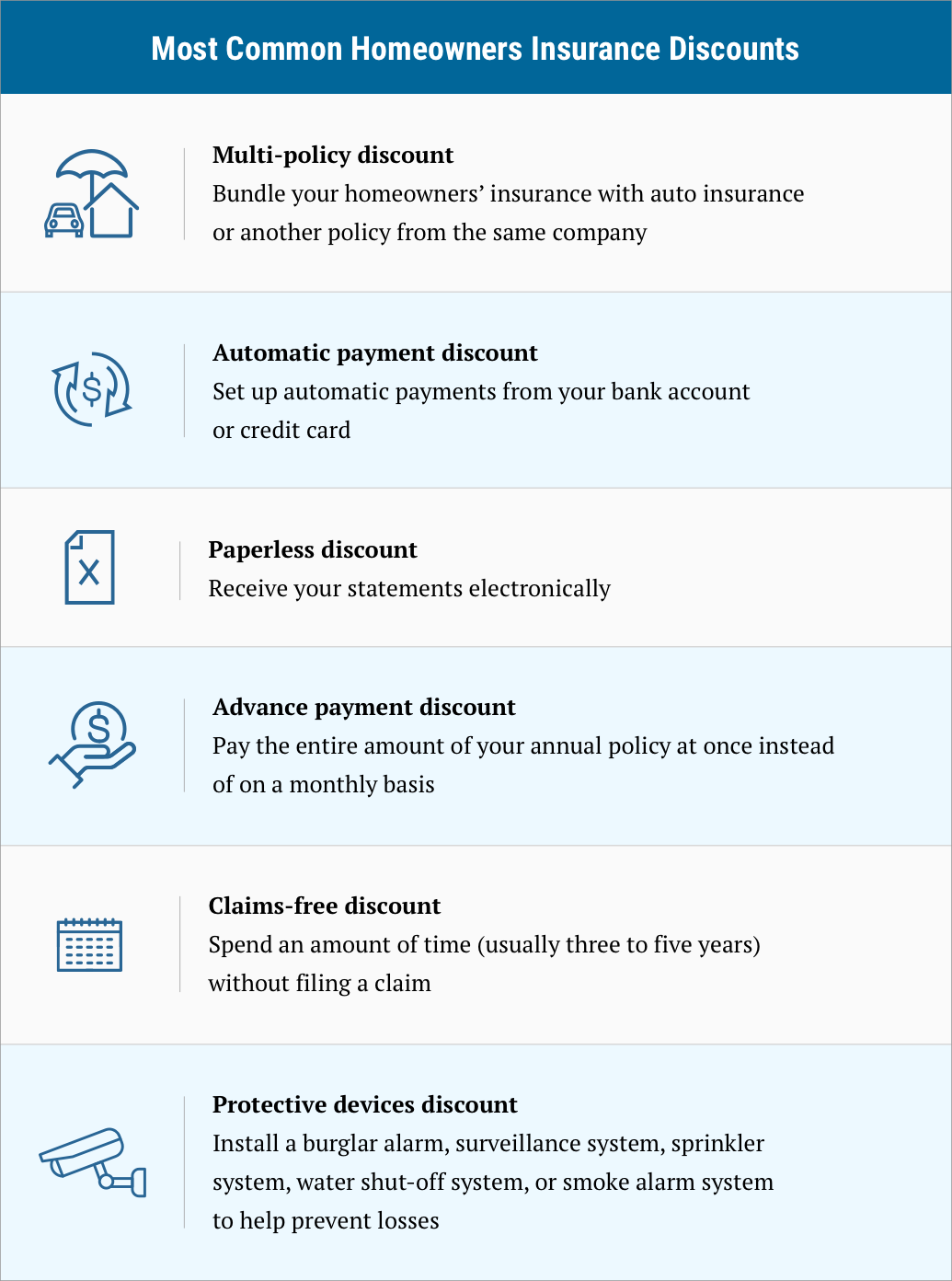

On the other hand Assurant doesnt offer optional coverage in other areas that are quite common such as trip collision and identity theft coverage. Homeowners insurance protects your financial interests if your home is damaged or destroyed by a covered peril. Hazard insurance is the part of your homeowners insurance policy that covers the structure of your home from common perils such as fire vandalism and theft.

Not all insurance policies include every type of hazard or natural disaster coverage. The average cost of mobile home insurance is typically between 500 and 1100 per year according to American Modern Insurance Group. The stockholders may receive a dividend at the end of the year.

The two basic coverages typically included in mobile home insurance policies are for physical damage and personal liability the Insurance Information Institute III says. 1 mortgage insurance premiums initial and annual 2 third party charges 3 origination fee 4 interest and 5 servicing fees. We cover the described mobile home on the insured premises including.

Property Removal up to 500. If you live in an area thats high-risk for a hazard or natural disasters such as hurricanes or flooding you may have to add insurance for the specific. The HECM loan includes several fees and charges which includes.

The lender will discuss which fees and charges are mandatory. The dividend paid to a stockholder is income taxable. D any trailer owned by the insured or spouse.

A Nationwide homeowners policy includes not only the standard coverage youd expect but also a type of insurance. Some examples of home insurance hazards include floods earthquakes tornados hurricanes and landslides. Insurance coverage for mobile and manufactured homes is usually similar to a standard homeowners policy offering coverage for the home your personal property and liability claims.

C any auto used as a temporary substitute while an insured auto is being repaired. All the following attributes are found in stock insurance companies EXCEPT A. If you hear someone mention hazard insurance they are likely referring to a homeowners insurance policy.

Coverage B with a limit of 10 of Coverage A. Besides being easy to find online Assurants mobile home insurance also includes flood insurance coverage something almost never included in standard mobile home or homeowners insurance policies. All of the following statements about yacht insurance are true EXCEPT.

Construction material located on the insured premises for use in connection with your mobile home. Hazard insurance is a term sometimes used to describe the coverages that homeowners insurance provides for certain risks according to the Consumer Financial Protection Bureau CFPB. The company is owned by the stockholders.

Each policy contains coverage for the loss of food in your refrigerator and freezer usually up to 500. However not all policies are equal. The board of directors is chosen by a state based electin board.

If one of these perils causes damage to your house youll be covered up to certain limits for repairs to your home. Coverage C with a limit of 50 of Coverage A. This includes replacements for such items that remain a permanent part of the mobile home.

Coverage C with a limit of 50 of Coverage A. Two types of risk that are not normally included in any home insurance policy are. B any auto shown in the declarations.

Buying coverage for replacement cost helps to bridge the gap caused by inflation and the loss of value when. Not all insurance policies offer homeowners the replacement cost of the property.

6 Best Homeowners Insurance Companies Of 2021 Money

The History Of Foremost Home Insurance Foremost Home Insurance Mobile Home Insurance Home Insurance Insurance Policy

6 Best Homeowners Insurance Companies Of 2021 Money

What Is Dwelling Coverage Insuropedia By Lemonade