Is Homeowners Insurance More Expensive On Older Homes

Expect to pay at least 1400 a year for homeowners insurance and use this data as a jumping-off point in your search. But despite being potentially cheaper than a newer home your older home may be costing you more to insure.

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

The average premium for a home older than 30 years is more than 60 more expensive than the average rate for a newly constructed home.

Is homeowners insurance more expensive on older homes. Outdated electrical wiring Building standards have changed over the years and some older homes have features that dont meet modern building codes. Yes usually annual premiums are high but it depends on the home. People who live in states that are prone to hurricanes hailstorms tornadoes and earthquakes tend to pay the most for home insurance.

Homeowners insurance for rental properties is actually known as landlord insurance. Older homes are viewed by homeowners insurance companies as high-risk they can be fragile construction materials are more obsolete and certain structural components like the roof or plumbing may not be in very good shape and therefore homeowners insurance premiums. Many companies find that the increased costs of insuring an older home justify higher premiums for consumers.

You might think an older homes insurance premiums would be much lower but theyre actually higher because of the increased upkeep required to maintain an older home. As a result typical home insurance premiums may increase due to an older home. A number of reasons and situations can spell higher rates for homeowners.

As a general answer to the question older homes are often more expensive to insure. If you buy an older home you can expect to pay a higher premium for homeowners insurance. Because myriad factors go into home insurance rates the profile used in our methodology may not align with yours.

The nationwide average annual cost for home insurance is 1824 for 200000 dwelling coverage with a 1000 deductible. We found that for a home that is 20 years old the average home insurance premium can be 56 more expensive than the average rate for a new home. There are many factors which affect your new home insurance rates and some of them may surprise you.

One of the things I love most about what I do is sharing what I know and I come across people every day who are mystified when they find out that an older home is. Typically older homes are more expensive to insure than newer homes. With a modified replacement cost insurance policy coverage is far more comprehensive but its also more expensive.

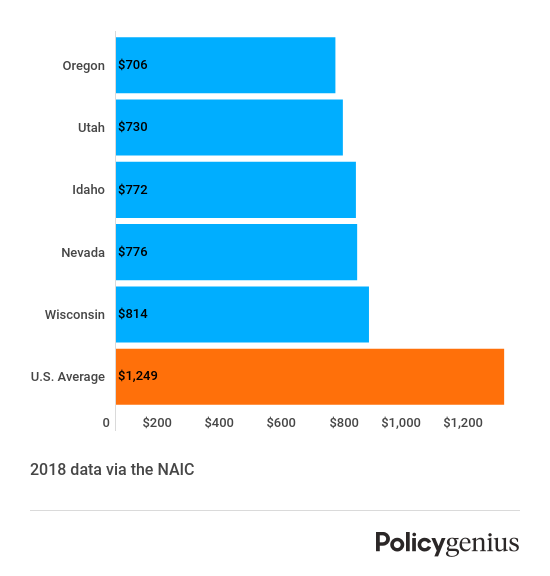

Make sure youre covered for the move. Location is one of the biggest factors in your home insurance rates. Its possible that an older home may cost more to insure as the materials and features in older homes can be more costly to repair and replace things like plaster walls ornate moldings stained-glass windows and hardwood floors Herndon explains.

1 day agoFor reason of the higher risk posed by an unoccupied property this coverage is more expensive than regular insurance often significantly so. In fact in nearly every case it is more affordable to insure a new home over an old home. Old homes cost more to rebuild or repair so insurers mitigate their risks by charging higher rates.

Mobile home insurance is generally more expensive than standard homeowners insurance. Insurance carriers offer several types of insurance for older homes including high-value homeowners policies HO-8 policies and HO-3 policies. Homeowners Insurance for Older Homes Tips Expert Advice Older homes are hard to insure because repair costs are much more expensive.

Youve dutifully insured your new home and kept the insurance on your old one until its sale closes. Thats because mobile and manufactured homes are less able to withstand incidents such as floods and fires. The cost of repairing period details or replacing outdated electrical and plumbing systems can drive up the cost of.

Several things could lead your insurance company to charge higher home insurance rates for an older home. This type of coverage tends to be more expensive due to the increased risk non owner-occupied homes carry.

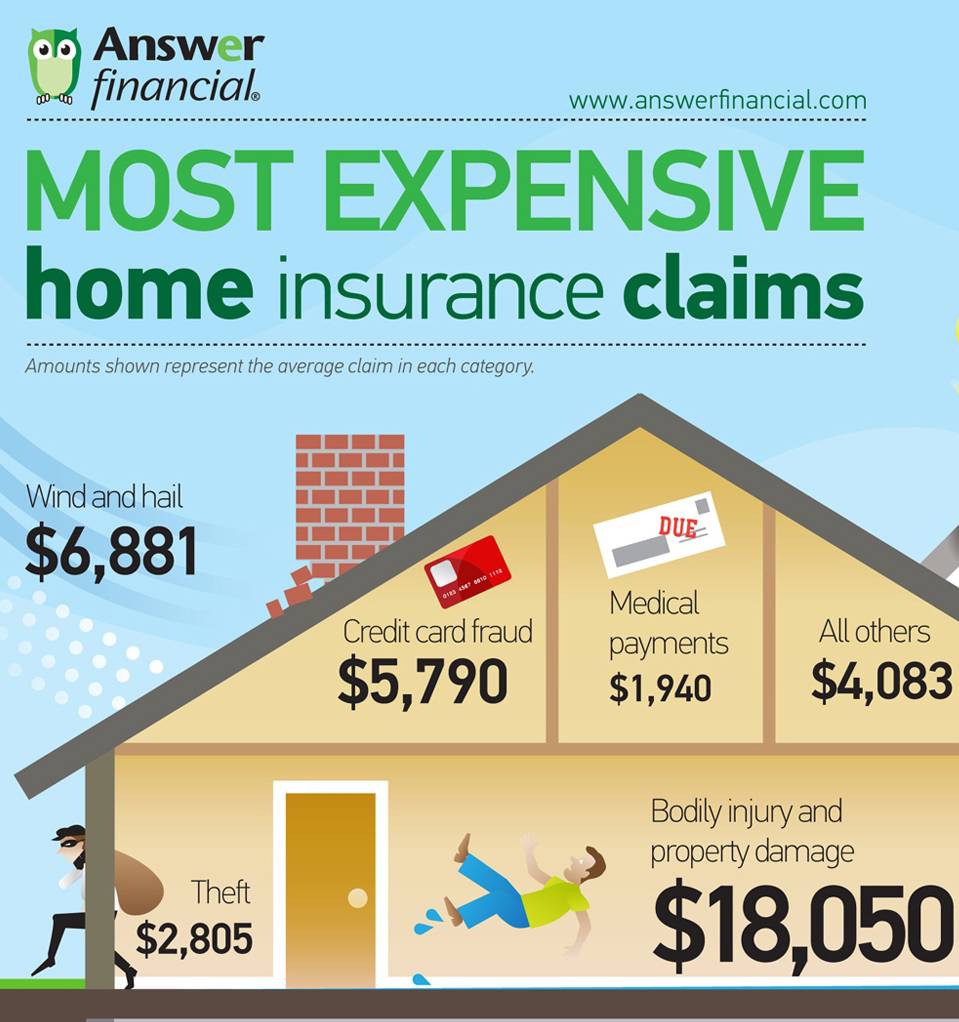

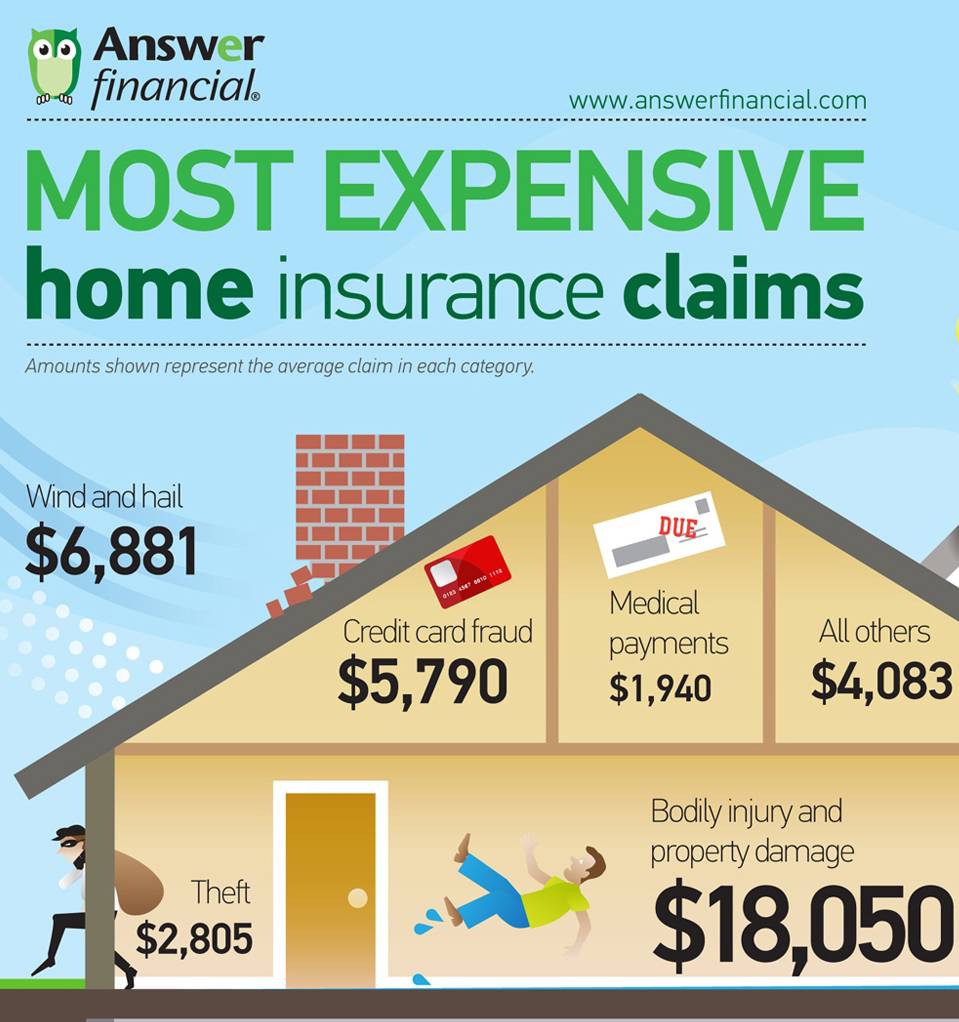

Most Expensive Home Insurance Claims

A Home Warranty And Home Insurance What S The Difference

The Best And Cheapest Homeowners Insurance Companies In Texas Valuepenguin

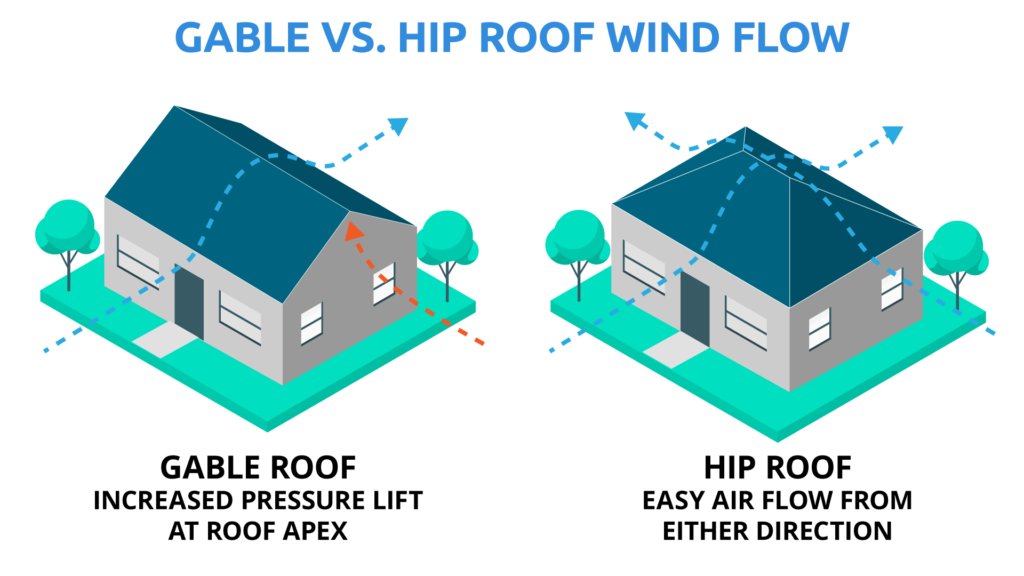

How Your Roof Shape Affects Your Homeowners Insurance Premiums