Indiana Home Insurance Rates

93 rows Average Homeowners Insurance in Indiana. This compares favorably to the states average cost of 1395 providing a 463 price break on average policy costs statewide.

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

Home insurance rates may vary between home insurance providers which is why you should compare rates before you buy home insurance.

Indiana home insurance rates. This is down from 983 in 2015 and further down from 1003 in 2016. Top 3 Cheapest Homeowners Insurance Companies in Indiana Buckeye State Mutual. Cincinnati Insurance provides the most affordable home insurance in Indiana at only 932 annually.

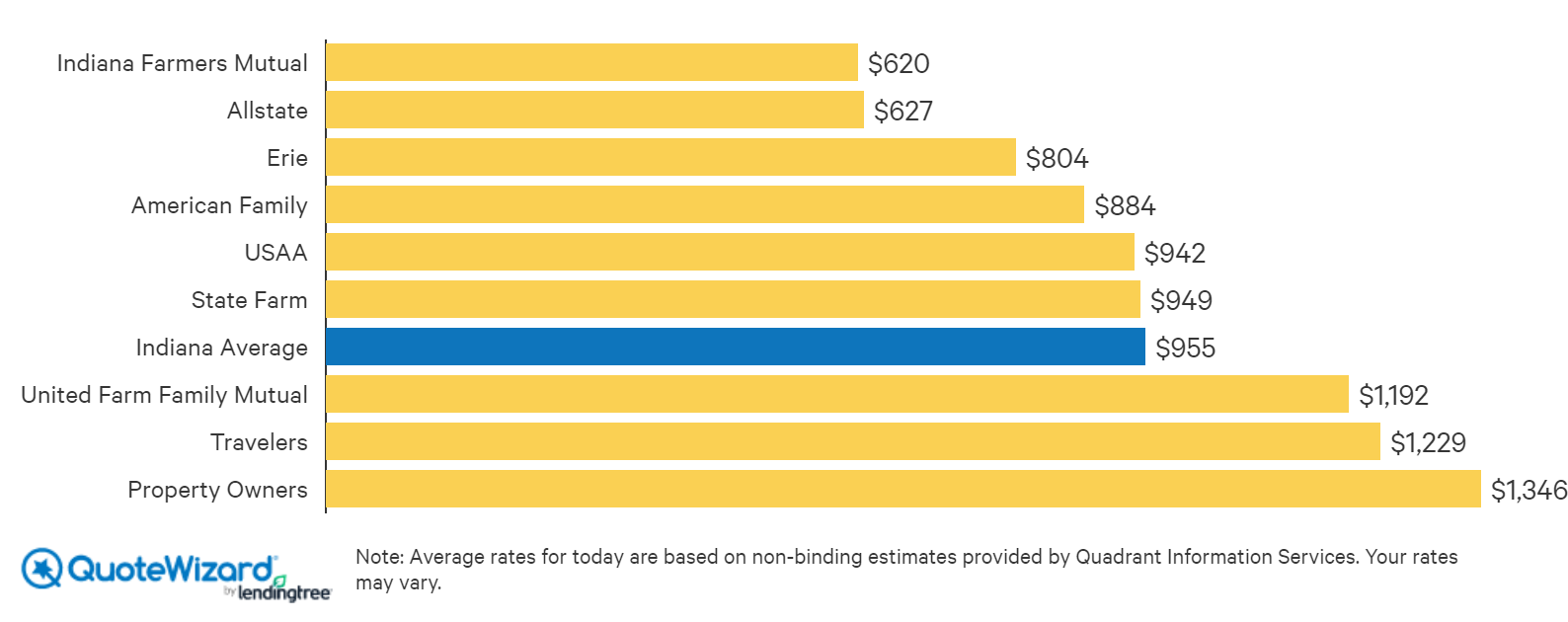

On average the annual homeowners insurance premium in Indiana is 1198 or 30 less than the national average. 94 rows Indiana homeowners will currently pay an average 955 per year or 79 a month in home insurance premiums. Rates shown do not include abstract or attorneys fees for title opinions or certificates charges for searches escrow or closing services charged by or paid to local attorneys abstractors and title companies.

Indiana home insurance can cost as little as 537 per year but we recommend shopping for more than just the cheapest insurer. 509 Indiana Farmers Mutual. Affordable homeowners insurance in indiana cheap homeowners insurance indiana homeowners insurance quotes comparison florida homeowners insurance companies best insurance companies in indiana state of indiana homeowners insurance homeowners insurance.

This is considerably cheaper than the citys average homeowners premium of 1195. That figure is 1149 or 546 less than the national average which is 2103. The most affordable home insurance in Fort Wayne is Allstate offering average annual rates at just 970 per year.

Various factors associated with the individual and the area where the property is located help insurers calculate home insurance policies costs. 1272 United Farm Family Mutual Insurance. Indiana Home Insurance Companies Mar 2021.

A homeowners insurance policy will cover your familys personal belongings your home and the contents of your home such as furniture appliances rugs clothing etc. We show average home rates for three other common coverage levels at. Start your search for a home insurance policy by reviewing the cheapest companies in Fort Wayne Indiana listed below.

The rate you pay depends on several factors including the city where you live so your rate may vary from the average. A local Indiana Allstate agent can help you learn more about a House Home policy. The national average is 2305 but most people pay somewhere between 1500 and 3000 each year on homeowners insurance.

List every major item and its value. The average cost of homeowners insurance in Indiana is around 954 for a 100000 dwelling coverage baseline. There are a few assumptions behind the data in our map.

Rates shown are the companys filed Risk Rate Loan Policy rates and other common charges. Gives you 100 off your home deductible when you sign up plus an additional 100 off each year you dont have a claimup to 500 3. Top 3 Most Expensive Homeowners Insurance Companies in Indiana State Farm.

The average home insurance rate nationwide is 2305 per year for policy limits of 300000 for liability and dwelling protection though exactly what you pay depends on where you live the age and type of materials of your house the amount of coverage you buy and other factors. 820 Median Home Price in Indiana. The Best and Cheapest Homeowners Insurance Companies in Indiana Compare.

Homeowners in Indiana pay close to the national average of 1228 per year for homeowners insurance. Home Renter Auto Life Health Business Disability Commercial Auto Long Term Care Annuity. Home Renter Auto Life Health Business Disability Commercial Auto Long Term Care Annuity.

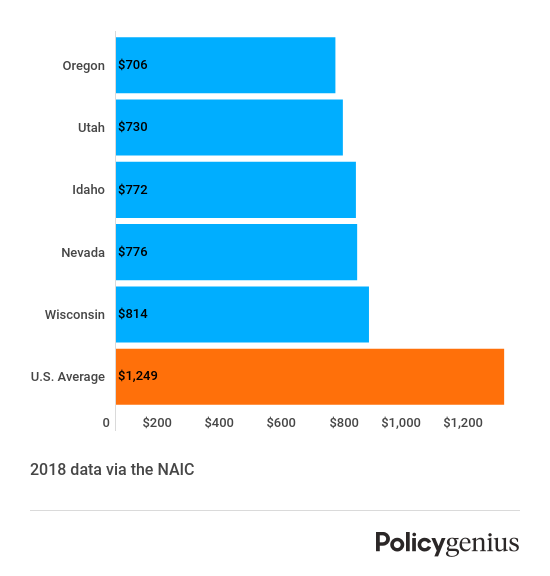

1398 Property Owners Insurance. 428 Cincinnati Insurance. As youll see in the homeowners insurance cost by state chart below Oklahoma is the most expensive state for home insurance 2140 more than the national average for the coverage level analyzed.

Homeowners insurance rates in Indiana will vary based on the insurance company you choose. Whether you own or rent you should make an inventory of all your furniture appliances rugs clothing furs jewelry etc.

Best Home Insurance Rates In Indiana Quotewizard

Indiana Farm Bureau Rates Consumer Ratings Discounts

The Best And Cheapest Homeowners Insurance Companies In Indiana