How Much Is Errors And Omissions Insurance For Home Inspectors

Coverage for Most Add-On Services Included at No Additional Charge. The cost for Professional Liability varies much more depending on the extent of inspection services.

Insurance For Home Inspectors Errors Omissions General Liability Internachi

As an independent insurance agency RISKPRO has access to many of the top home inspector professional liability insurance companiesWe also have access several markets for other types of home inspector insurances such as general liability insurance and bondsThis allows us to provide our clients with coverages that are tailored to their specific needs at highly competitive premium rates.

How much is errors and omissions insurance for home inspectors. Protects your business against costly legal and settlement expenses from mistakes oversights and errors during your own inspections and those of subcontractors. Or 155 a month. Errors and Omissions Insurance Providing EO Insurance to Professionals from 150Year.

Errors Omissions EO. Home inspector insurance provides protection in the event a lawsuit is brought as a result of damages that occur as a result of inspections services. Regardless of policy limits the median monthly cost of errors and omissions insurance is 59 713 annually.

But as for what level of cover you need youll need to decide whats best for you. Low 1500 Deductible from year one most insureds. And it only take a few minutes.

Its always best to over-estimate. Home inspectors typically have a need for both Professional Liabilityoften referred to as Errors Omissions or EO insuranceand General Liability to cover third-party bodily injury and property damage claims. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

InsuranceBee can help take some of the headache out of the insurance-buying process for you. Do You Need Professional Liaiblity Insurance. And an architect pays.

We offer up to 1000000 cover. How much does home inspector insurance cost. Home inspector EO insurance could help protect your business.

Other home inspector insurance you might need. A basic policy can range from 600 to 1200 per year while a more extensive policy with the aforementioned hazardous materials test can cost from 2000 up. OREP is a leading provider of Home Inspector EO insurance and General LiabilityPremises Coverage nationwide serving inspectors for over 19 years.

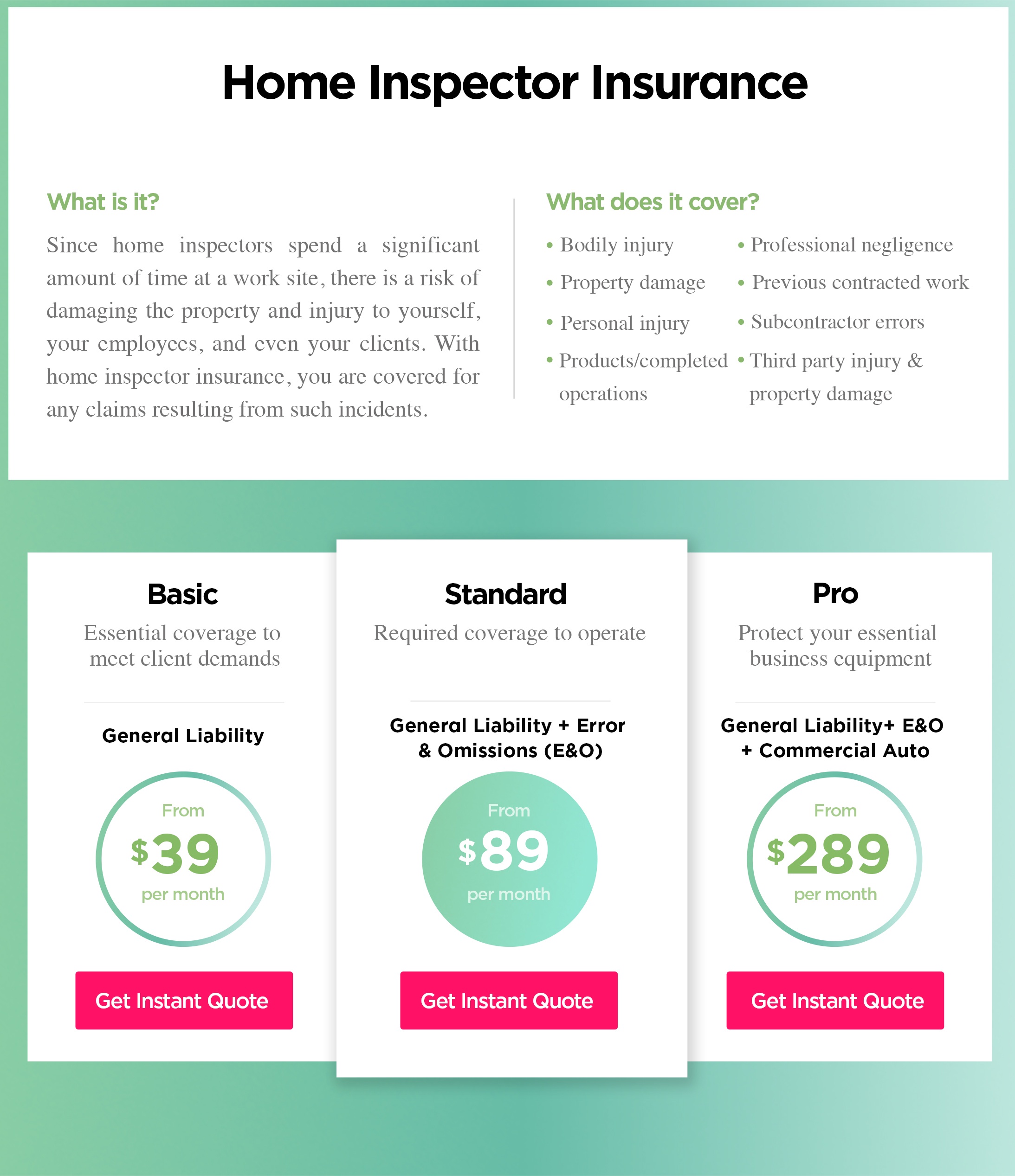

Here at InspectorPro we dont believe in generic off-the-shelf coverage that fails to meet our clients needs. A variety of deductibles options from 1500 to 10000 The total dollar amount that will be paid for. You can get a combination policy from as little as 89 a month.

For a basic EO policy which does not cover work around hazardous materials the cost can range from 600-1200 per year. For inspectors testing Radon mold asbestos and other hazardous materials the cost can often starts at 2000 per year. For instance if you test things like radon mold or asbestos the cost will be much more expensive than a basic errors and omissions policy.

Pays for damages from accidents that occur while traveling to. It probably doesnt surprise you that architects and engineers pay the most for errors and omissions insurance. This coverage also called errors and omissions EO insurance protects your business against claims of negligence real or not.

Prices for home inspector EO insurance will vary based on specific factors. Since EO insurance for home inspectors can be tailored to your specific businesss needs and services offered annual deductible options range from 1500 to 10000 and liability limits range from 100000 to exceed 1000000. Liability insurance has many facets.

For example a buyer claims a roof issue was not noted and alleges negligence. Based on a 20 down payment and 9 monthly installments. InspectorPro Insurance is the leading home inspection insurance provider for errors and omissions general liability and workers comp.

Premium Discount for Experienced Inspectors and Membership in Professional Associations Includes Deductible Forgiveness Program Up to 1500 reimbursed by warranty company OREP in its 16 th year serving the insurance needs of home inspectors. We designed our exclusive errors and omissions EO and general liability GL insurance program to cater to home inspectors unique coverage needs. With combination home inspector policies starting at 89 a month we can find you an insurance package to suit your exact business needs.

On average an engineer pays 1825 a year for an EO Errors and Omissions insurance policy. The policy can be tailored to your specific businesses needs and services offered including. Speak with a knowledgeable agent to find out how much home inspection insurance you need to be fully protected.

Home inspectors professional liability aka errors and omissions offers coverage for claims against a home inspector for errors omissions negligence and failure to identify defects.

How Much Does Home Inspector Insurance Cost Commercial Insurance

5 Reasons Home Inspectors Need E O Insurance How To Get It All American Training Institute Usa

E O Liability Home Inspector Insurance Cost Coverage Requirements Ati Academy We Know Inspections

Home Inspector E O Insurance Cost And Top 4 Providers Bravopolicy