Best Home Insurance Deductible

Normal options for policy deductibles are 500 1000 2500 and sometimes 5000 when we are speaking about homes valued under 1 million in reconstruction value. However you can choose to increase your deductible based on the size of your home.

Choosing The Best Home Insurance Deductible Quotewizard

As a rule of thumb we recommend that your insurance deductible should be 500 to 1000 depending on where you are located.

Best home insurance deductible. These are sample rates and should be used. Best for green homes. If your home is insured for 250000 and your policy has a 2 deductible 5000 is how much you would be responsible for.

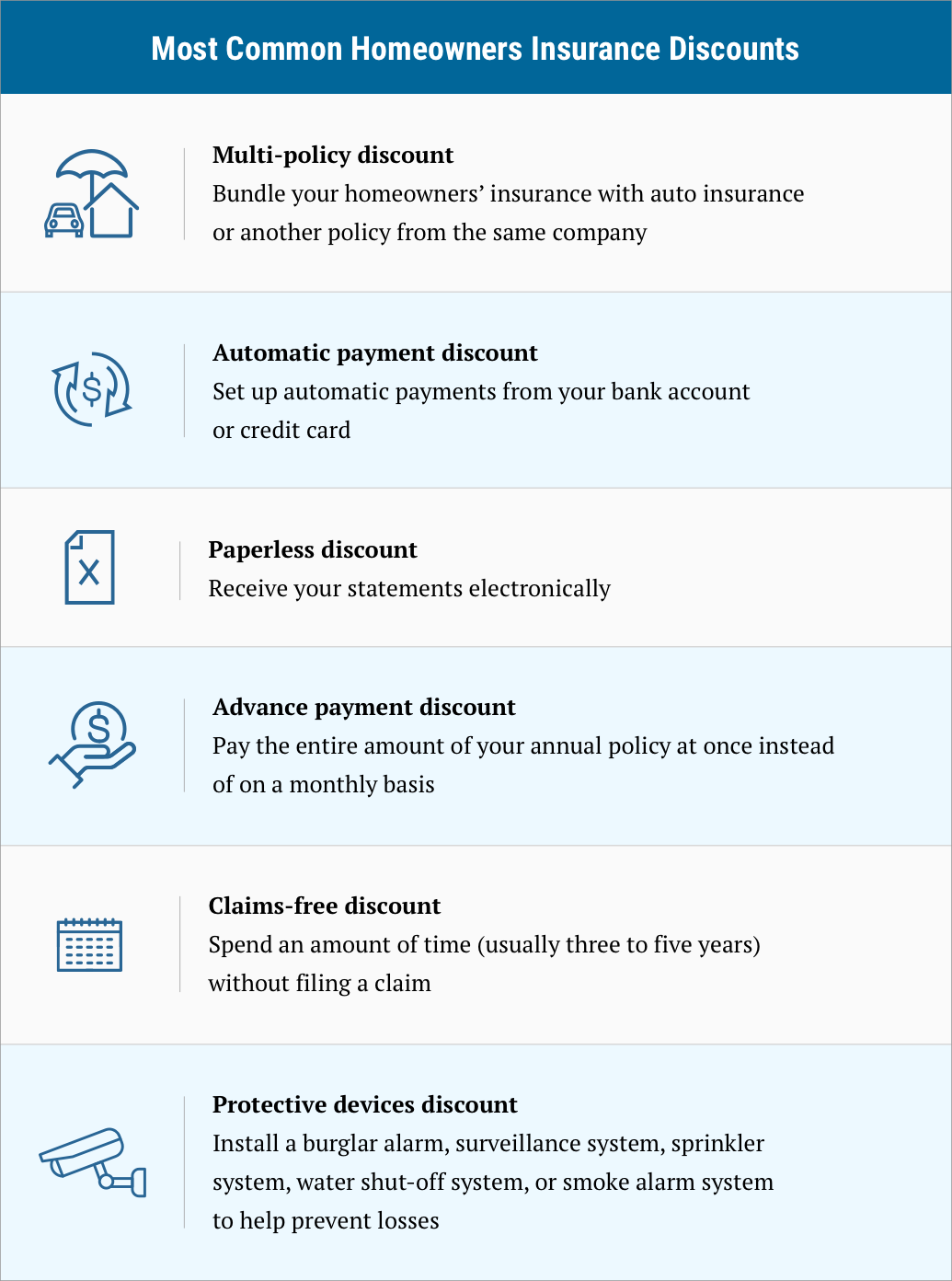

Raising your deductible is another way to lower your premiums since you are taking on more risk by paying more out of pocket if you have a claim. Best for policy discounts. Read reviews and our detailed analysis of Marysville MI Homeowners Insurance compare quotes to get the best deal from the most trustworthy providers.

They can save an average of 675 each year. The average homeowners insurance deductible is usually somewhere between 500 and 1000 although depending on the company you may be able to choose a deductible as low as 250 or as high as 2000. Homeowners insurance is one of the best ways to protect your most expensive asset.

Best cheap home insurance companies Irvine. Flushing average yearly premium. Its easy to think things like fire major storms and burglary wont happen to.

It is a fixed amount you pay every time you file a home insurance claim. The amount would basically be deducted from your claim payment so if your total loss were 35000 the coverage amount would be 3000000. Military and their families.

However most companies offer deductibles of 1000 and up. A dollar-amount deductible is also known as a flat deductible. Theres no standard deductible for homeowners insurance.

Best for bundling home and auto. Insurance costs are specific to each home owner and area. Florida homeowners who pay the most for home insurance nationwide save the most by increasing their deductibles from 500 to 2500.

The homeowners also have a 1000 deductible and a separate wind and hail deductible if required. Usually a higher deductible means lower insurance premiums and a lower deductible means higher insurance premiums. Most companies have a base deductible of 500.

Michigan average yearly premium. Many companies offer smaller homeowners insurance deductibles of 500 and even 250. The homeowners also have a 1000 deductible and a separate wind and hail deductible if required.

Best for a fast quote. Thatcher Rd State St Tasker Rd Brumm River Rd Brooks Rd Brott Dr West St S Woodland Rd Eagle Point Rd W Francis St. Typically homeowners choose a 1000 deductible for flat deductibles with 500 and 2000 also being common amounts.

This may be the average homeowners insurance deductible but you shouldnt limit yourself to this choice. Best for replacement cost coverage. A standard typically 500 to 2000 for most causes of loss and percentage deductibles typically 1 to 5 for windhail or hurricane-related damage.

The most common home insurance deductibles offered on average are 500 1000 and 1500. Every deductible offers a percentage discount off the base premium of your insurance policy. These average premiums are just to give you an idea of the price you might pay.

Auto and home insurance also have deductibles but they apply for every single claim you make no matter how many you make in a year. These are sample rates and should be used. The best homeowners insurance companies of 2021.

Homeowners Insurance Quote for Woodland MI Deductible Home Value Location. What is the Standard Deductible for Homeowners Insurance. A 1000 deductible tends to be the most common choice.

Marysville MI homeowners insurance is about 633 to 863 about 52-71month. Our detailed research shows customers can save upto 299 by getting multiple quotes. Best for the US.

Companies rarely offer no-deductible policies but when they do policies come with higher premiums. Most homeowners insurance policies include two types of deductibles.

6 Best Homeowners Insurance Companies Of 2021 Money

6 Best Homeowners Insurance Companies Of 2021 Money

What Is A Homeowners Insurance Deductible Valuepenguin

What Is A Homeowners Insurance Deductible Valuepenguin