Average Home Insurance Cost Long Island

Coastal Insurance Solutions specializes in. However some natural disasters arent covered by homeowners insurance such as flooding and earthquakes.

The Best And Cheapest Homeowners Insurance Companies In New York Valuepenguin

130 per 100000 of mortgage amount Mortgage Tax If getting a mortgage.

Average home insurance cost long island. Photos 21 Map Directions. 333 Route 25A Suite 150. Read reviews and our detailed analysis of Staten Island NY Homeowners Insurance compare quotes to get the best deal from the most trustworthy providers.

To revisit the common rates for a multimillion-dollar home on Long Island NY rates often fall within a range of 018 per 100 of insured value up to 021 per 100 of insured value. 1-3 Family Home or Condo. Our extensive analysis indicates shoppers can save as much as 258 by getting multiple quotes.

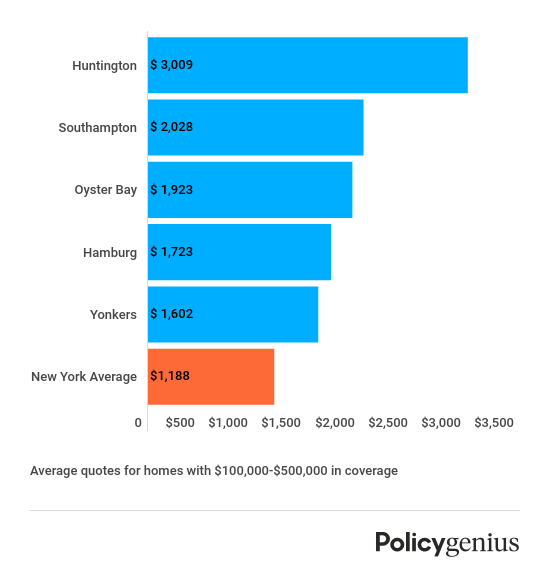

Title Insurance Fee. Average cost of home insurance in New York by city Insurance companies will also price policies differently based on where you live. The cost to insure a multimillion-dollar home.

This equates to a total average annual cost in Long Island of 142350. Below by using our home insurance calculator you can find average home insurance rates by ZIP code for 10 different coverage levels. This is considerably more expensive than other parts of the state such as Central Nw York where the average cost of long-term care is 264 daily or 96360 per year on average.

Through our comparison study of rates our agents found Long Island the most populated island in the United States residents have slightly lower premiums with an average quote of 2274 annually or 189 per month for full coverage. Property makeupAge style construction type heating and other characteristics of your home will all play a part in determining your premium cost. Approximately 450 per 100000 of sales price under 1Mil Loan Origination Fees Points 1 -2 of mortgage amount dependent on lender.

Of course some may be higher and some may be lower but lets work with that range to learn how that rate. 080 of loan amount. Depending where your home is located in Nassau your home-owners insurance premium fee can vary.

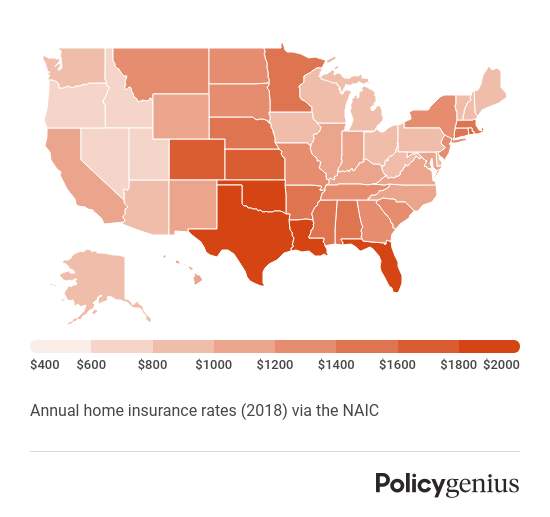

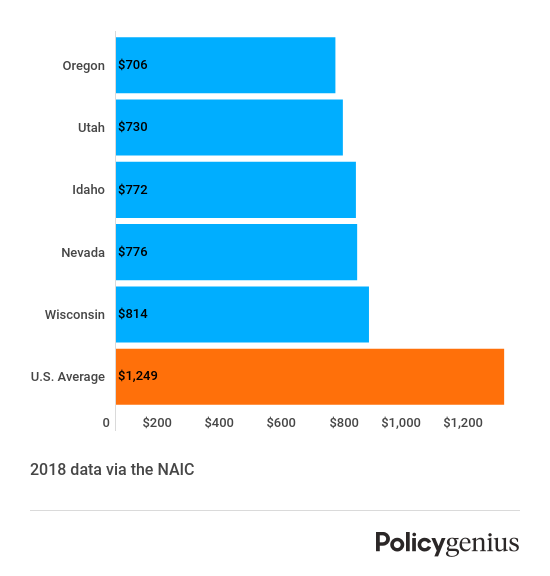

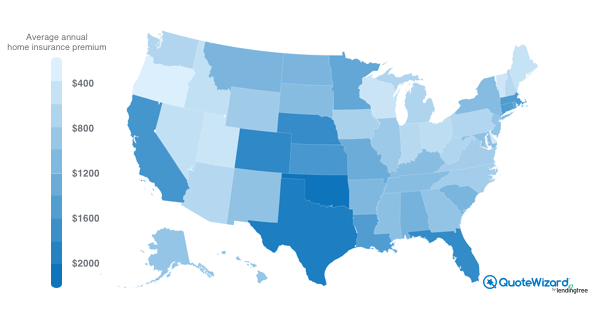

Some of those factors are the age of the dwelling the square footage of your home its location and the construction materials. Travelers has fairly average customer service reviews among NY home insurance companies. The average home insurance cost is 2305 nationwide but it can vary by state.

Home insurance rates at Travelers were slightly more affordable than average at 893 per year. To get multiple home insurance quotes for your home in Nassau please contact our office or just submit the form below Get a Quote Now. Homeowners insurance is there to protect you from damages caused by storms fire and lightning.

Nursing home care costs vary in upstate New York from 264 per day in Central New York to 308 per day in the Rochester area which is approximately 96360 per year in Central New York to 112420 per year in the Rochester area. Many factors figure into the cost of your homeowners insurance policy. The Empire S tate average rate is 2412 per year.

Our detailed analysis indicates shoppers can save upto 262 by getting multiple quotes. Downstate nursing home costs vary from 340 per day in the Northern Metropolitan area to 390 per day in Long Island which is approximately 124100 per year in the Northern Metropolitan area to 142350 per year in Long Island. But other large home insurance companies like Allstate and State Farm charged much more.

Average prices of more than 40 products and services in Long Island NY United StatesJun 2021. We found that the town of Huntington on Long Island has the highest rates in the state with a 3009 average annual premium for 100000-500000 in coverage. The average homeowners insurance premium in Nassau county is about 1200 to 1600 per year.

Read reviews and our detailed analysis of Suffolk County NY Homeowners Insurance compare quotes to get the best deal from the most trustworthy providers. Prices of restaurants food transportation utilities and housing are included. According to 2021 insurance carrier data overall average annual premium for homeowners insurance is 1312 about 109 monthly based on a.

Rocky Point NY 11778. 15 rows The most expensive ZIP codes for home insurance in New York are clustered around the Upper East. Suffolk County NY homeowners insurance is roughly 549 to 742 about 45-61month.

Visit Website Email Business. Long Island NY homeowners insurance varies in cost as many factors determine how much your particular cost for home insurance will be. The average cost of homeowners insurance in Suffolk County NY is 1000 to 3000 per year.

Staten Island NY homeowners insurance is about 558 to 754 about 46-62month. Enter in your ZIP code then select a dwelling coverage amount deductible and liability amounts. Lets take a look at the most common underwriting criteria.

It really depends on your replacement cost coverage also known as the dwelling amount.

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

Homeowners Insurance In New York Policygenius

Average Cost Of Homeowners Insurance 2021 Quotewizard