Multi Family Home Insurance Cost

This can be a duplex four-plex apartment condominium or townhouse. Insurance for both living on and off the property.

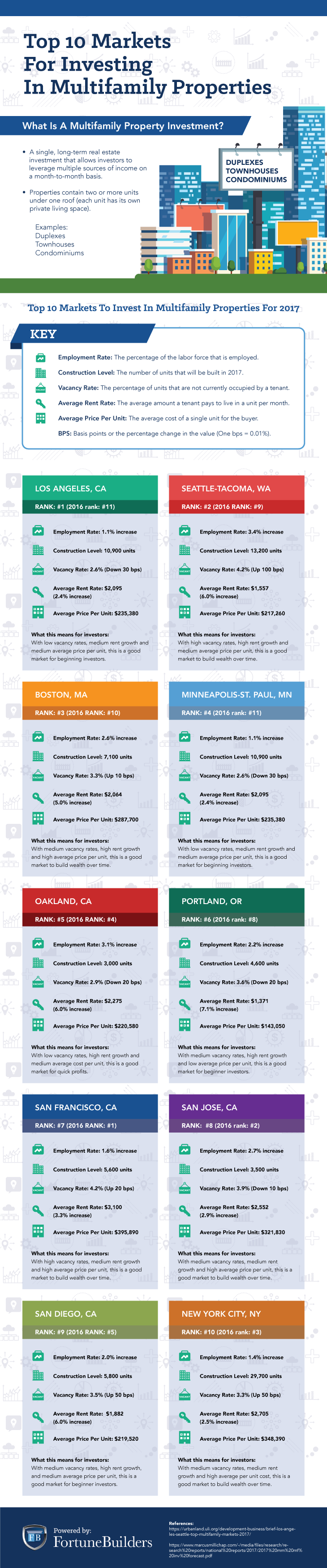

Investing In Multifamily Properties The Complete Guide Fortunebuilders

One for living on the property and one for owning the home.

Multi family home insurance cost. The warranty provider will then dispatch a technician to the residence to diagnose the issue. To discuss your own insurance needs call the Gordon Atlantic Insurance professionals toll free at 1-800-649-3252. What kind of insurance do I need for a multi-family home.

Congrats youve purchased a multi unit property whether its a duplex property triplex or a 4plex you want to make absolutely sure your investment is properly insuredIf you want solid protection for your interest and your occupantstenants of your propertybuilding then a duplex triplex and multi unit insurance quote is the. Cheap home warranty plans may cost only a few hundred dollars for the entire year. By combining General Liability Coverage and Commercial Property Insurance business owners benefit from simplicity and cost savings.

However some people nonetheless have a certain amount of anxiety about it. Property insurance for duplex triplex and 4plex units. Being apprehensive about insurance.

When something in the home fails the homeowner files a claim. Esposito insurance group landlord insurance. Generally more than a homeowners.

Insurance Quotes Online Comparison Home Insurance Multi-Family Home Insurance. If you live in the home a standard home insurance policy can be purchased from some but not all companies. Furthermore these same people are going to have a certain amount of trepidation about multi-family home insurance as much as they are about single-family home insurance.

If you own the multi-family and the business you can combine policies to reduce your premium. The insurance costs for multi-family properties can be mitigated by certain factors. A small business owner may pay as little as 500 per year while a major corporation could pay 500000.

Homeowners subject to the mandatory purchase requirement must insure for at least the lesser of the outstanding principal balance of the mortgage the NFIP coverage cap or the insurable value of the property. 125 - 15 rule from Juan Vargas. For insurance purposes multi-family dwellings are dwellings capable of housing more than one family with multiple bathrooms kitchens and bedrooms with a separating wall between them.

For example if your dwelling is insured for 250000 and. Its usually set between 50 to 70 of the dwelling coverage amount. It puts pressure on your broker and carrier.

This coverage pays to repair or replace your personal belongings. When Japan experiences earthquakes floods and typhoons the losses incurred by an insurance company will actually have an impact on the cost of your insurance here in the US. Call your broker and tell them you want to increase your deductible.

Your agent is a valuable re- source when assessing your insurance needs. 250unit rule from Gino Barbaro. The WI apartment deal isnt a traditional apartment building so I tried it on one more building.

Upgraded plans that cover additional items are more expensive. Property owners should also be careful to obtain insurance that will reimburse them for the replacement rather than acquisition cost of the assets. Email Your Policy For A Free Consultation.

There many variables that play into your insurance needs such as location age of building and architecture that can only be determined on a case by case basis. Our favorite way is to shop around. Age of the property.

These are some of the factors that can have a negative or positive effect on your insurance quotes. Insurance policies for 3 and 4 family homes are not offered by many companies but they remain the best mix of coverage and price. Multi-family home insurance is by no means a complex aspect of homeowners insurance.

6200 seems high Broker proforma. More limited under the DP-3 than the HO-3 as there are tenants living there not the owner. In 2017 insurance companies paid out 135 billion globally for damage from natural disasters and storms.

I analyzed a 52 unit in Indiana going for 265MM. Newer properties are often in a better state of repair and more likely to meet local code requirements than older properties. OM actual insurance cost.

They tend to be very affordable with the average cost of an HO3 annual premium at 1235 in 2021. It usually covers attached structures belongings and personal liability as well. Since there are a wide variety of multi-family properties such as duplexes quad-plexes apartments condominiums or townhouses the amount of coverages and cost vary wildly.

There are two different options when it comes to insuring your multi-family property. For reference in 2014 the mean building cove rage for single - family homes was 194460 and the median was 250000. The average business pays between 1000 and 3000 per million dollars of coverage.

It doesnt cover every type of damage however. Property Off Premises 50000 Newly Acquired Buildings 250000 Valuable Paper 50000 Off Premises Power Failure 25000 Accounts Receivable 50000 Transit 25000.

Investing In Multifamily Properties The Complete Guide Fortunebuilders

Investing In Multifamily Properties The Complete Guide Fortunebuilders

A Guide About Buying A Multifamily Home Quicken Loans

Investing In Multifamily Properties The Complete Guide Fortunebuilders