Pool Coverage Home Insurance

Homeowners insurance typically helps pay to repair a pool if its damaged by one of the risks covered by your policy. Home insurance generally covers the pool itself too.

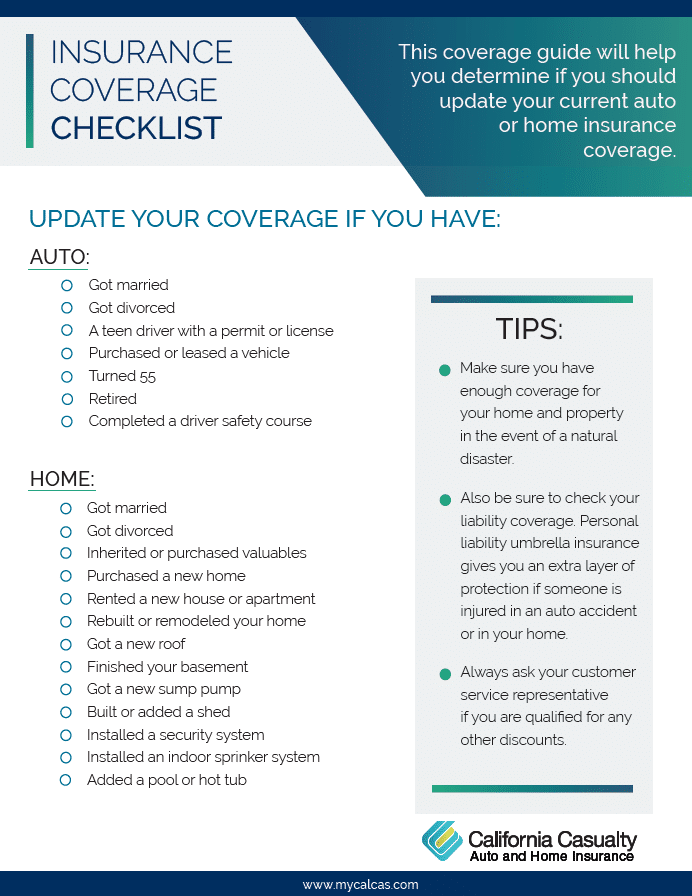

You Should Update And Revise Your Insurance Policy Once A Year You Could Be Missing Out On Major Savings Visit Www Resources Checklist Insurance Coverage

Liability insurance for residential pools is often included in a general homeowners insurance policy.

Pool coverage home insurance. A pool damage insurance claim might fall under one of three portions of your home insurance policy depending on the pool and insurance carrier. Does Home Insurance Cover Pool Damage. If a storm knocked a neighbours tree branch into your pool and ripped the liner then you could very well have a successful claim in the making.

Higher coverage limits are more costly. The standard liability protection you get with home insurance covers pool accidents. Covered risks usually include fire and falling objects.

Other structures coverage and liability. It is important to note that the surge in claims and COVID-19 restrictions will extend the claims process as there are a. Having a pool can increase your homes liability risk.

Some insurance companies classify a pool as an unattached structure which is covered by Coverage B in a home insurance policy. But if your pool has no fence around it and someone is accidentally injured or drowns home insurance may deny you coverage since you didnt install the. So if for instance a tree falls on your pool homeowners insurance will likely help pay for repairs up to the limits stated in your policy.

Other structures coverage applies if the actual physical structure of the pool is damaged. Homeowners insurance can help pay for legal and medical expenses if someone gets injured or drowns while using your swimming pool. Homeowners insurance will cover pool repairs if its damaged by one of the perils covered by your policy including fire hail and vandalism.

Home insurance with a pool will typically include damages to your pool and liability claims made against you. Homeowners insurance will pay to repair or replace your pool when a covered peril causes its damage. Your homeowners liability coverage also applies to the pool covering you against injury claims that could arise through its use.

Since swimming pools inherently cause more potential for injury adding additional liability insurance like umbrella policy can be beneficial. This means that if a guest is hurt or dies while using your pool your home insurance will pay for their medical costs and your legal protection. Does homeowners insurance cover the pool liner.

The Insurance Council Of Texas expects the following days will be the largest insurance claim event in history as millions of customers file claims for the damages brought on by the storm. FAQ Houston Freeze. Typically homeowners insurance coverage will differ based on the type of pool in your yard.

While in-ground pools are typically covered as part of your dwelling coverage or other structures coverage when it comes to damage an above-ground pool may be categorized as personal property or other structures. Homeowners insurance will cover pool damage but what type of damage youll be covered against will depend on the type of pool. However the coverage limit varies.

Home insurance policies can include up to 100000 in liability insurance but if you have a pool insurance companies wi recommend you to increase your home insurance liability coverage to 500000. Of the 16 covered perils the likely causes of pool damages might be falling objects high winds from hurricanes and tornadoes. If someone is injured in your pool homeowners insurance will cover it.

Does my homeowners insurance policy cover damage to in-ground pools. A swimming pool whether above-ground or in-ground is eligible for homeowners insurance coverage as a scheduled structure or under other structures blanket coverage In other words because it is a detached structure like a shed its not covered under your homeowners policy unless you specifically add coverage for the swimming pool. Liability coverage and swimming pools Pools are what insurance companies call an attractive nuisance- meaning both children and strangers will be tempted to go to your pool.

Pool liner leaks or repairs generally fall under the regular maintenance category but certain situations could warrant a home insurance claim. In most cases your home insurance policy will cover your swimming pool in two ways. Having a swimming pool will increase your homeowners insurance premiums.

If your pool is a permanent part of the home eg an in-ground pool it would be considered under coverage B other structures and is covered against the same types of events as your house aka Coverage A dwelling coverage. And like all insurance the coverage limit affects your premium lower coverage limits are more affordable. Where you live may impact if your pool is covered and how its covered.

If you have a pool you should think about increasing your liability protection if you havent done so already. Weve broken down and explained all of the above mentioned scenarios below. If you have a swimming pool thats listed under other structures in your policy your coverage limit for the pool is about 10 percent of your dwelling coverage.

Others consider it personal property which is covered by Coverage C. Its recommended pool owners increase their liability coverage amount to anywhere between 300000500000. Keep in mind that homeowners policies exclude coverage for damage caused if water freezes in your pool.

Are Pools Covered By Homeowner S Insurance Pool Companies Pool Cover Homeowners Insurance

Exceptional Coverage For Your Distinctive Home And Vehicle Homeowners Insurance Home And Auto Insurance Insurance

Homeowners Insurance Time For An Annual Check Up Homeowners Insurance Best Homeowners Insurance Home Insurance Quotes

Pool Insurance Nsicovered Homeowners Insurance Group Insurance Insurance