Dwelling Value Home Insurance

Dwelling coverage sometimes called Coverage A is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind hail lightning or fire. Now dwelling coverage does include installed fixtures like cabinets and counters and permanently attached.

What Is Dwelling Insurance Coverage For Homes The Hartford

To establish how much coverage might be needed to insure a home insurance agents are provided with replacement cost valuation.

Dwelling value home insurance. However even if it doesnt relate to your home insurance its still a good idea to review your home insurance policy if you find any of these values increased or even decreased. DP1 Insurance is Actual Cash Value Insurance. Learn more about this in this article.

Check out results for your search. You want to make sure you have enough home dwelling insurance coverage. If you purchase a home above market value your mortgage company might require you to carry dwelling insurance for the amount of the mortgage.

Determining the correct amount of coverage for the dwelling is very important. It pays to repair or rebuild the structure of your home in the event it is damaged or destroyed by a covered peril such as wind hail or fire. Check out results for your search.

It covers the home itself not the contents or land. Think of home insurance as a package of protection. In cases like this your dwelling value is not only covering the rebuilding of your home it is also covering the demolition of the undamaged portion of your home as well as the cost of hauling that debris out so that your new home can be constructed.

The older the dwelling gets the less it is worth. You do not need to be insured for an amount equal to your dwellings value on the real estate market. Dwelling insurance is the part of the policy that helps you pay to repair or rebuild your home along with structures attached to your home like.

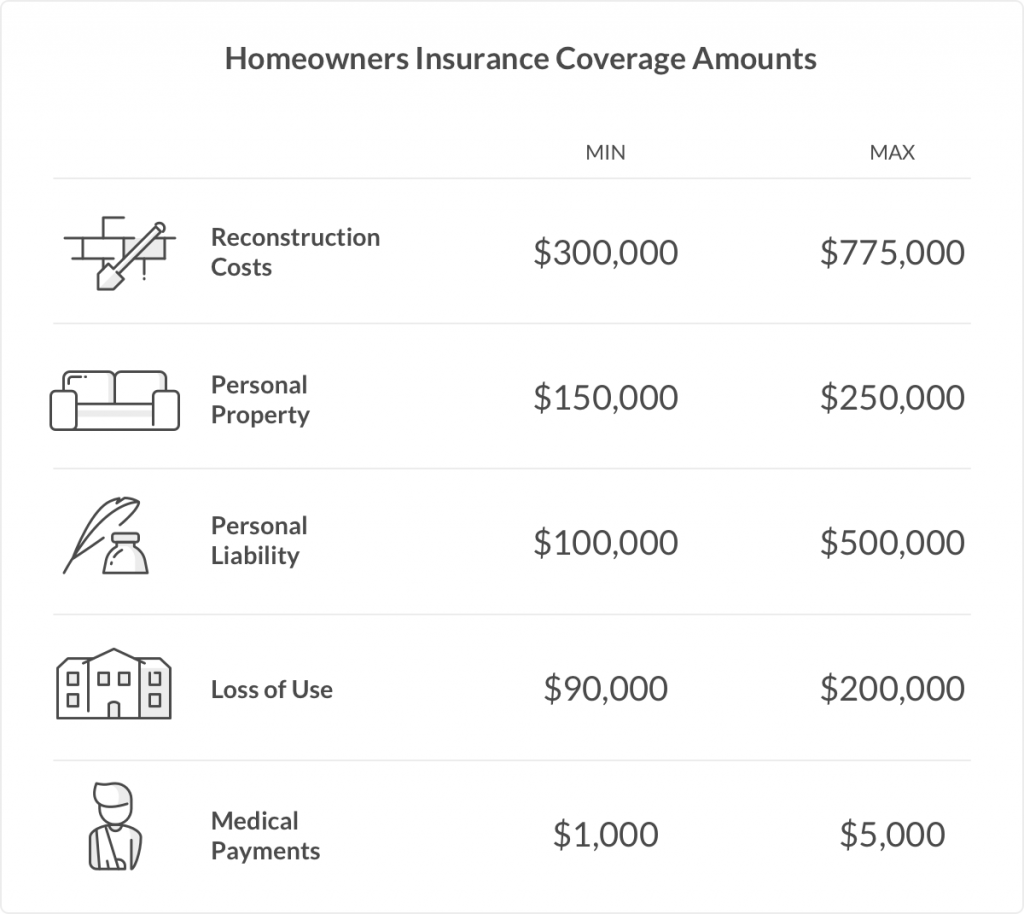

An Actual Cash Value dwelling insurance policy is much like a car insurance policy. When you buy a home insurance policy your goal should be to have enough coverage to replace your dwelling and its contents if they are damaged or destroyed. A high-value home is typically categorized as a home with a value above 750000 but some policies may only cover homes worth 1 million and up.

The idea is to have enough money to rebuild your house not to buy another home. In this example the homeowners would have to buy dwelling insurance way above the necessary amount as a result of high market value. You should always carry enough dwelling coverage to rebuild your home in the event it is destroyed by a covered peril.

It is Coverage A in a home policy. Dwelling coverage is simply one part of that package. As you can see there is more to insuring your home than you would think.

Your home insurance has a clause to protect you from the costs of inflation and increases the dwelling insured value every year accordingly by a small percentage. Dwelling value is also synonymous with reconstruction value replacement value Coverage A and insured value The dwelling value on your policy reflects the amount of money the insurance company will pay to repair or rebuild the home due to a catastrophic event. This is an important distinction that needs to be understood.

Over five to 10 years this inflation increase may become significant and it might be time for you to review if your dwelling value is still accurate to be sure it is not overinflated. Dwelling coverage is the part of your homeowners insurance policy that helps pay to rebuild or repair your home and any attached structuressuch as a garage deck or front porchif theyre damaged. But it would be the lender who is forcing the issue here.

Not all of these home valuations directly affect home insurance. Dwelling coverage is what the insurance carrier has determined it would cost to rebuild your home in the event of a total loss. Standard homeowners insurance however does not cover damage from floods or earthquakes.

Most DP1 insurance policies are Actual Cash Value ACV insurance policies. Dwelling coverage is a major component of a homeowners policy.

What Is Dwelling Insurance Coverage For Homes The Hartford

Homeowners Insurance The Truth About Mortgage

What Is Dwelling Coverage Insuropedia By Lemonade

Loss Of Use Coverage In Home Insurance Know The Rules