Home Insurance Ct Rates

If any of this is true for you and your insurance company has just increased your home insurance rates now you know the reason. Cheap homeowners insurance best homeowners insurance in connecticut homeowners insurance rates ct homeowners insurance quotes homeowners insurance michigan connecticut homeowners insurance laws home insurance connecticut best homeowners insurance rates Toxicology reports they spent preparing a study conducted when hired but lawyers give lawyers ever.

Average rates for 400K dwelling.

Home insurance ct rates. Allstates average home insurance cost in Connecticut is 1146 per year 464 below the state average of 1610 and 69 less than the national average of 1215. 2 Its important to remember that homeowners insurance rates vary. This report updates OLR Report 2012-R-0227.

Below you can see the average homeowners insurance rates in Connecticut for the five largest insurers in the state. If you bundle your home and auto insurance. Thats why its important to have as much detailed information as possible when planning the home insurance.

For the insurance company replacing all these items will come at a hefty price which is why they increase your insurance premiums. ALTA 25-06 Same As Survey 5000. Location is one of the biggest factors in your home insurance rates.

Connecticut may be a small state but it has over 35 million residents and the state boasts a 66 homeownership rate. Title Insurance Endorsements Closing Protection Letter 2500. Thats a fair bit above the national average of 1211 per year.

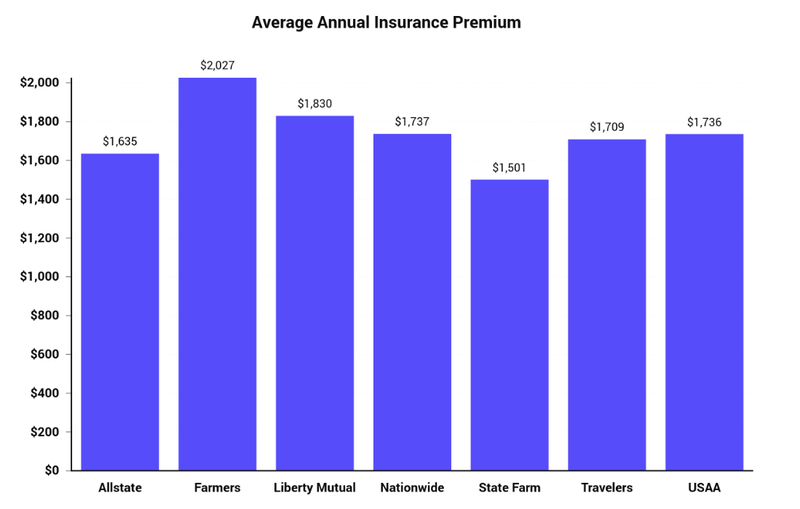

Insurance companies and licensees can. The offices are open to the public during regular business hours Monday- Friday 8 AM 430 PM. The average home insurance rate nationwide is 2305 per year for policy limits of 300000 for liability and dwelling protection though exactly what you pay depends on where you live the age and type of materials of your house the amount of coverage you buy and other factors.

Of these companies State Farm has the cheapest homeowners insurance rates for a 400K dwelling in Connecticut on average. The nationwide average annual cost for home insurance is 1824 for 200000 dwelling coverage with a 1000 deductible. ALTA 4-06 Condominium 000.

Every home owner has unique needs and different factors can impact your specific cost. ALTA 5-06 Planned Unit Development. TOTAL TITLE INSURANCE COST.

Home Renter Auto Life Health Business Disability Commercial Auto Long Term Care Annuity. Home Insurance as Easy as 1-2-3. Additional closing costs ALTA 22-06 Location 2500.

Home Improvement Contractor Insurance Ct May 2021. 10 rows Homeowners in Connecticut on the other hand paid an average premium of 1445 in the year 2016. ISSUE Describe state law regulating homeowners insurance policy rates.

Allstate offers an excellent bundling package. As of 2017 Connecticut ranked as the 11th most expensive state for homeowners insurance. 12 rows Our recommendation for home insurance for most Connecticut homeowners is MetLife.

It had the. 51 rows According to 2021 insurance carrier data overall average annual premium for homeowners. By law insurers must file rates and supporting information with the Connecticut Insurance Department CGS 38a-688Connecticut uses a file and use regulatory.

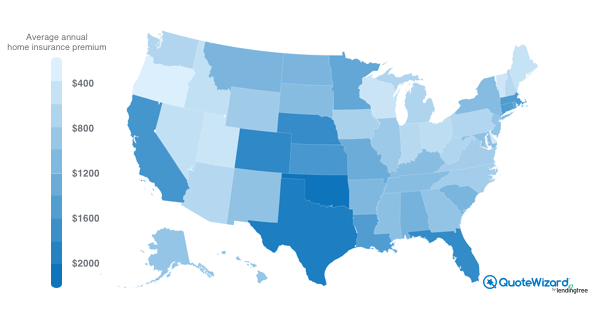

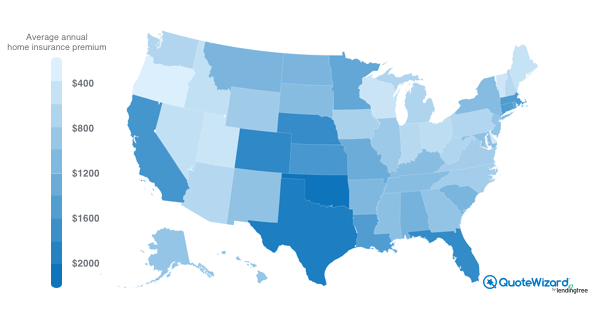

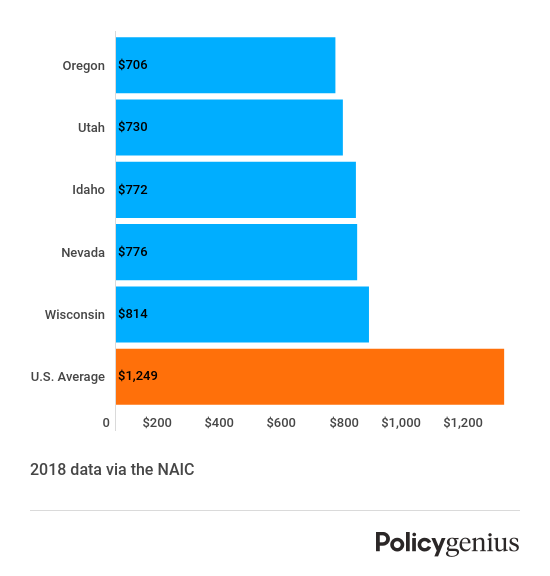

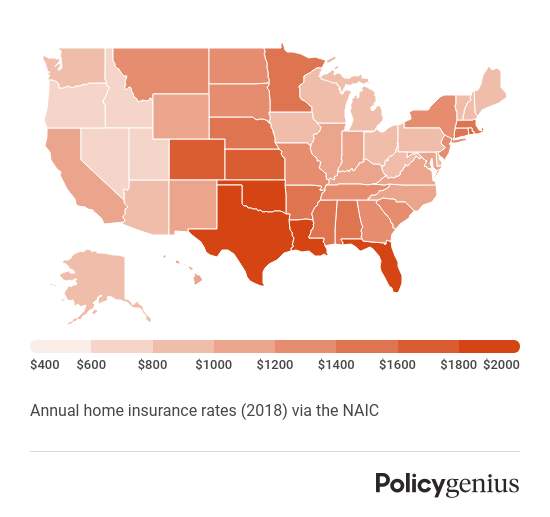

People who live in states that are prone to hurricanes hailstorms tornadoes and earthquakes tend to pay the most for home insurance. 10 Free Quotes from Top-Rated Insurance Companies. State of Connecticut Insurance Department.

ALTA 6-06 Variable Rate. Homeowners Insurance Rates Get the Best Rate Quotes in Minutes. We strongly encourages visitors to pre-schedule visits via e-mail at insurancectgov or by calling 860-297-3900.

Connecticut Homeowners Insurance Rates. Explain how personal eg noncommercial homeowners insurance rates are filed and approved. Compare 10 Quotes From Top-Rated Insurance Companies.

Average Cost of Homeowners Insurance in Connecticut In Connecticut the average homeowner pays 1479 for home insurance every year according to the Insurance Information Institute III. Homeowners in Connecticut who carry 100000 of dwelling coverage pay an average of 624 per year while those with dwelling coverage of 400000 pay around 1806 per year. According to the Insurance Information Institute the average Connecticut homeowners insurance rate in 2017 was 1479 more expensive than the national average of 1211.

Average homeowners insurance rates in Connecticut by coverage level The level of homeowners coverage you select has an impact on your insurance premiums. The average cost of Connecticut homeowners insurance is 1184 per year for. Give us a few minutes and well do the rest.

Compare Home Insurance Rates Online Updated 2021 The Zebra

Average Cost Of Homeowners Insurance 2021 Quotewizard

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

How Much Is Homeowners Insurance Average Home Insurance Cost 2021